Merry Christmas!

We wish you a joyful, merry, and warm Christmas with your loved ones.May the New Year 2024 bring you peace and fulfill all your dreams.

Forte Renewables offers Technical Advisory, Owners Engineering and Project Management services to renewable energy investors on a global basis. Established in Amsterdam in 2012 it provides expertise throughout the project lifecycle with a focus on Technical Due Diligence along with management of Engineering, Procurement and Construction stages.

We are passionate in our efforts to facilitate the green transition and look forward to powering your efforts to achieve your project goals.

1600MW of experience in Europe and Asia as Owners Engineers and Technical Advisor.

20+ countries experience in Europe, South America and Asia with focus on EPC Management.

50+ PV plants experience as Technical Advisor to investors from greenfield to operation stage.

Minimise risks to our Clients by validating provided documentary evidence against legislation, market norms, industry best-practice, and pricing/value indices from permitting to asset management.

Management on behalf of our clients of engineering, procurement and construction processes to account for national legislation, client and project specific requirements, industry best-practice, and CAPEX/OPEX optimisation.

Countries

Continents

Rated Power

Solar/BESS

Wind

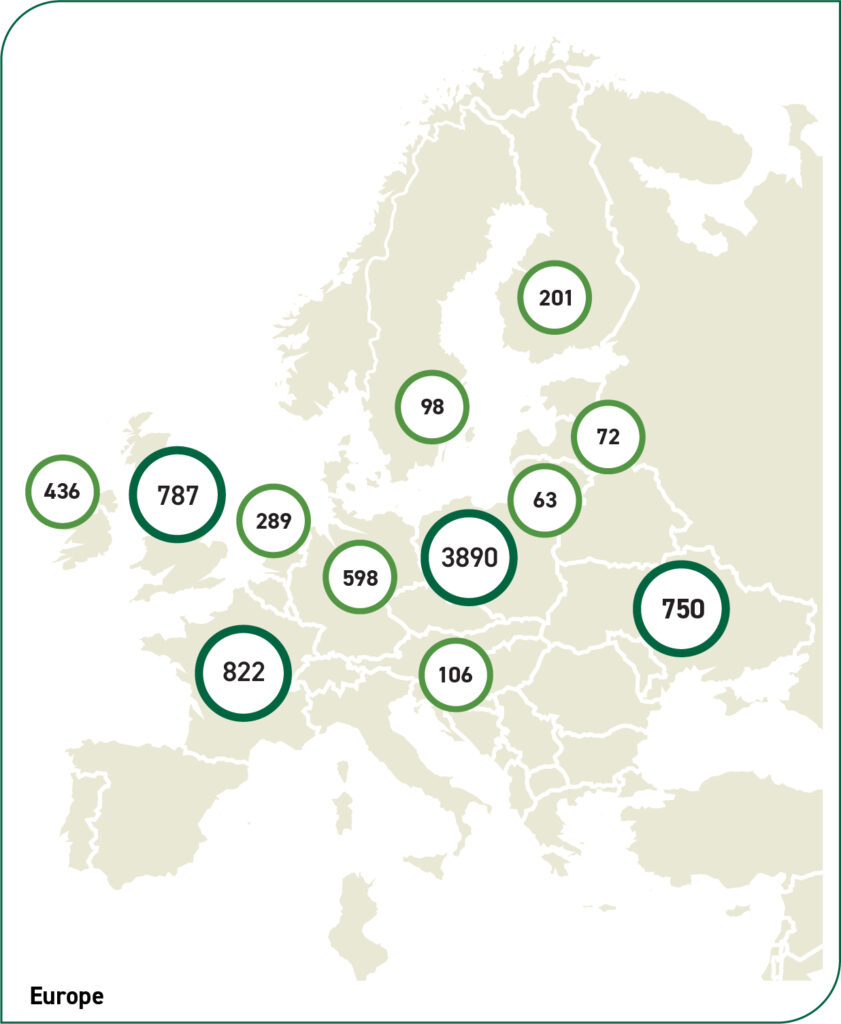

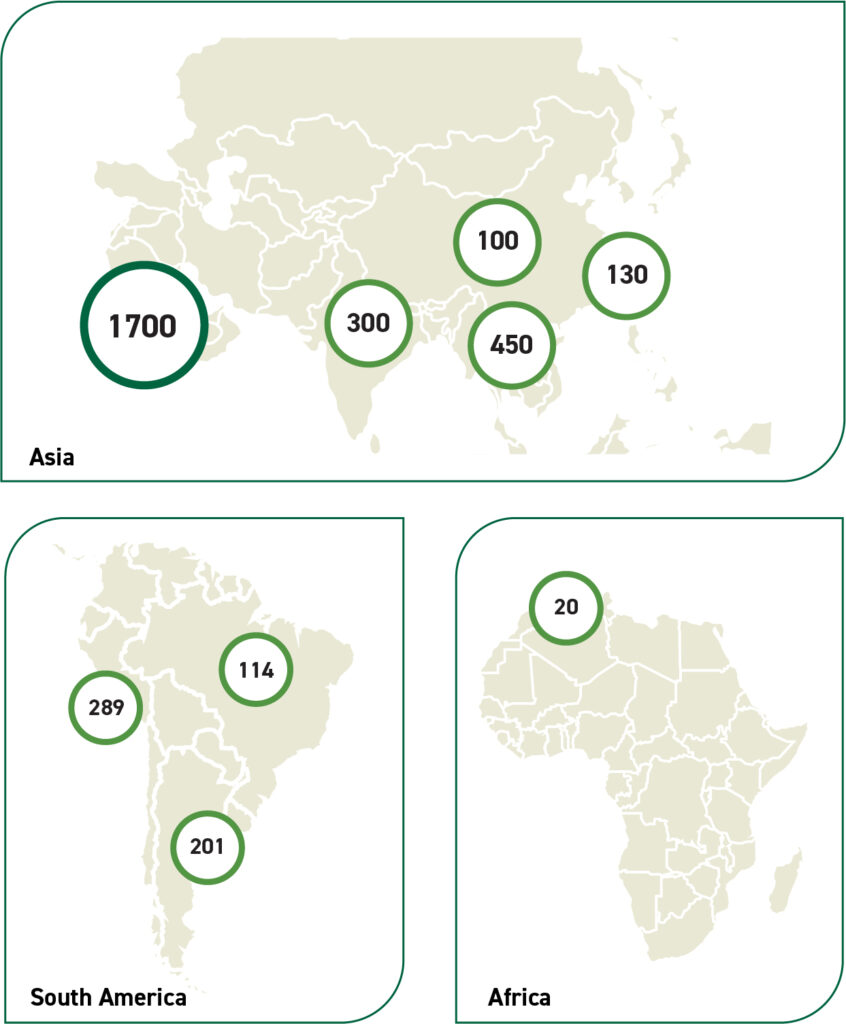

| # | Country | MW |

| 1 | Poland | 3890 |

| 2 | Saudi Arabia | 1700 |

| 3 | France | 822 |

| 4 | United Kingdom | 787 |

| 5 | Ukraine | 750 |

| 6 | Germany | 598 |

| 7 | Thailand | 450 |

| 8 | Ireland | 436 |

| 9 | Brazil | 404 |

| 10 | India | 300 |

| 11 | Netherlands | 253 |

| 12 | Finland | 201 |

| 13 | Bulgaria | 180 |

| 14 | Peru | 137 |

| 15 | Taiwan | 130 |

| 16 | Argentina | 114 |

| 17 | Serbia | 106 |

| 18 | China | 100 |

| 19 | Sweden | 98 |

| 20 | Estonia | 72 |

| 21 | Lithuania | 63 |

| 22 | Honduras | 50 |

| 23 | Morocco | 20 |

We wish you a joyful, merry, and warm Christmas with your loved ones.May the New Year 2024 bring you peace and fulfill all your dreams.

In today’s dynamic and demanding business world, acquiring and retaining top-class talent is becoming a key challenge for every organization. The value that an employer

“Why is Poland’s offshore wind sector drawing the attention of global industry leaders? What strategies are they pursuing, and what challenges and risks might they

Teleportboulevard 130 | 1043 EJ Amsterdam | The Netherlands | +31 6 2714 6905 | info@forterenewables.com

all rights reserved Forte Renewables 2022