Last time I provided an introduction to Wind Farm Asset Management (AM) and related costs so now we can move along to the next logical step….how to target cost savings.

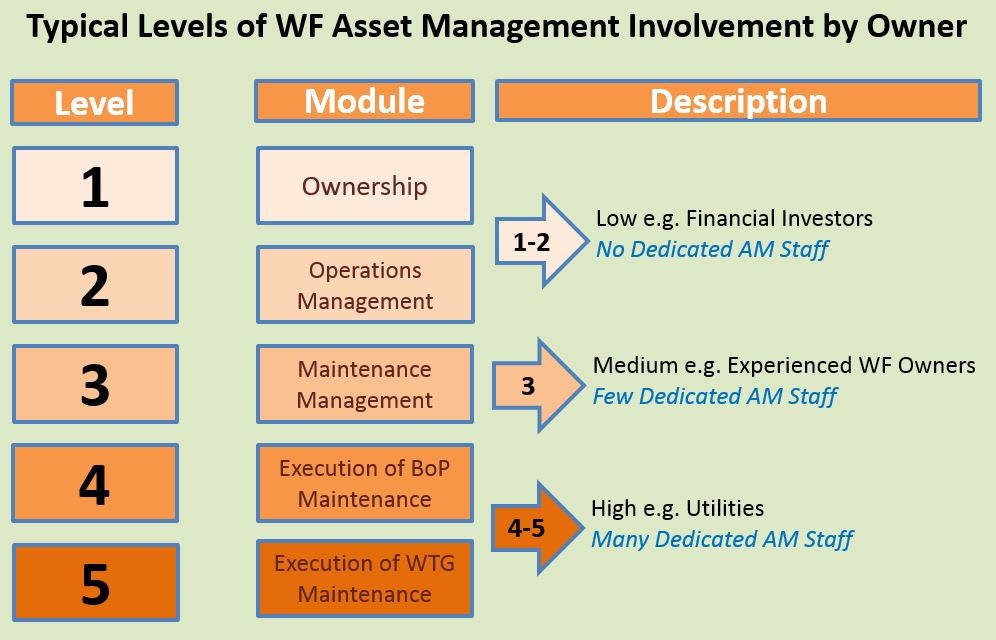

In order to maximise profits a wind farm owner must consider 1) what involvement they should have when managing their assets and 2) what stage of the life-cycle the project is at. Unsurprisingly most gains can be achieved for projects where operation has not commenced. Therefore lets focus on development projects as opposed to already operating assets for now.

Low/Medium Owner AM Involvement: Pros and Cons

For a small wind farm (1-10 Wind Turbine Generators (WTGs)) or a portfolio of small wind farms it does not make sense to have extensive in-house teams maintaining and operating the assets. Better keep it simple and manage effectively your chosen sub-contractors. This was the strategy chosen when I was working as part of a development team for a number of small wind farms in Northern France.

For medium sized wind farms (11-30 WTGs) more involvement including maintenance and spare part management should be considered. Economies of scale open up more possibilities than for the smaller wind farms.

The advantages of having minimal involvement is principally little or no investment or risk related to having in-house teams which will suit financial investors with small wind teams.

However minimal involvement will mean minimal share of gains from OPEX cost reductions. And it should be considered that service costs for smaller wind farms are higher than for larger wind farms which have economies of scale. So choose the level of involvement after carefully analyzing the options available.

Maximum Owner AM Involvement: Pros and Cons

For the largest wind farms or closely clustered portfolios with WTG numbers of 30+ significant owner involvement including having an in-house operations team (responsible for all data analysis/ reporting and control of the wind farm), maintenance team (servicing partly or fully all WTG and BOP) and direct access to major part replacement teams and equipment should be considered.

On the negative side this will involve building up through recruitment and long term training and coaching a team of competent technicians. Even when trained there will be a learning curve before the team can match expectations in terms of performance. This is a slow process requiring owner patience, the adoption of a culture of improvement in the organisation and lots of hard work.

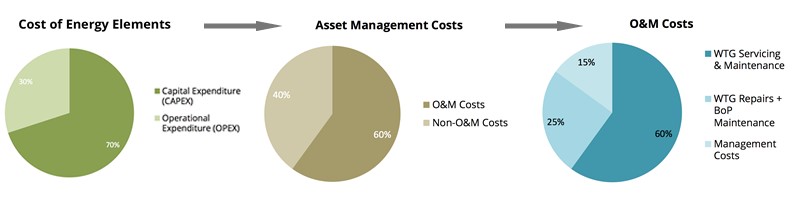

The question will be: “Is it worth the effort?”. Well the answer is “yes”. Studies by EON and other large developers have proven full in-house Asset Management can, if done in accordance with best-in-class practices, lead to cost savings of up to 25% of OPEX or up to 10% of CoE. In addition to lowering the costs for the first project this will establish the know how that can be used for future projects and portfolios and can, if desired, be offered as a service to other wind farm asset owners who have decided to take a lower level of involvement. (Numerous global developers such as WPD, RES, Statkraft etc are already doing this).

In markets such as Brazil a recent 20% drop in prices at auction, a weakening currency and little recent reduction in WTG supply or service contracts is reducing developers returns. Therefore making AM cost savings is essential and has resulted in significant appetite for developers to do full AM in-house.

Actual Cost Savings

– Wind Farm with 1-10 WTGs: Involvement Levels 1&2 → Negligible CoE savings potential vs industry average

– Wind Farm with 11-30 WTGs: Involvement Level 3 → Low % CoE savings potential

– Wind Farm with 30+ WTGs: Levels 4 & 5 → Up to 10% CoE savings potential

Systematic Way to Define Involvement and Target Savings

To best address the level of involvement question it is recommended to do an in-depth analysis and devise a comprehensive Wind Farm or Portfolio Asset Management Strategy. Only then can all project specific, regional and Turbine/BOP supplier limitations as well as client requirements be assessed and quantified.

More about that next time.

————————-

Next Week: Is there really a need for an Asset Management Strategy?

Fergal O’Mahony is Director of Forte Renewables. We are based in Amsterdam and provide Strategic Asset Management Consultancy to wind farm operators in Europe and Brazil.