If you are an experienced Wind Farm Operator successfully managing a portfolio of wind farms then you can skip this article. However, if like the silent majority of people involved in the wind industry, who are confused by the terminology used, when discussing operating wind farms then read on because perhaps I can remove some of the confusion.

Firstly, let me confess that, coming from a civil engineering background, I was once part of the majority who really struggled with understanding operating wind farms. I silently suffered through presentations by industry experts discussing topics such as wind farm operations and technical management followed by the benefits of operation and maintenance best practice, yield improvements, operations trouble shooting and data mining of SCADA (Supervisory Control And Data Acquisition). Dazed by the end of the presentations by jargon, fancy graphs and doctorate level mathematics I kept glancing at my nearest exit as the walls started closing in. Ahhh!

Asset Management versus O&M

I prefer to use the term Wind Farm Asset Management instead of Operations and Maintenance (O&M) when discussing management of operating wind farms. As you will see below O&M is only a member of the greater AM family. When I mention AM to counterparts in the industry sometimes I’m met by “don’t you mean O&M because I associate Asset Management with the stock market?”. Well no actually. By definition Asset Management can be considered as “a systematic process of deploying, operating, maintaining, upgrading, and disposing of assets cost-effectively.” For me that’s understandable language that non-turbine experts can digest.

Costs

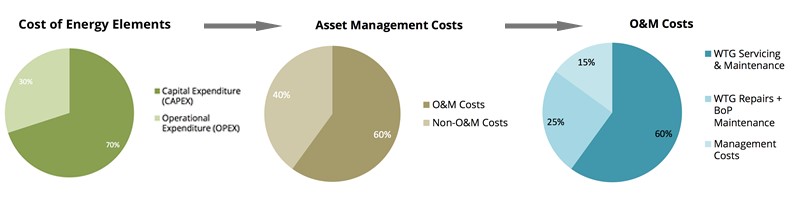

But what are the constituent parts of AM and their relative costs? (Note for laymen: for AM costs we must use the term the industry convention terminology of operation expenditure or OPEX). When we refer to Asset Management costs we must consider 2 main constituents – O&M Costs (~60% of OPEX) and Other costs (~40%).

AM Cost 1: Non-O&M Costs

Let’s start with the Other Costs before opening the lid on the O&M box of hopping frogs….This includes items such as land lease, royalty payments, community contributions etc. (items where there are fixed agreements which should not change during a wind farms lifetime) and also business rates, property taxes, electrical export and transmission fees, decommissioning provisions etc. (items which are subject to annual change and outside of the wind farm owners control).

AM Cost 2: O&M Costs

And then there are O&M costs. This refers to all activities related to operating all wind farm plant including WTGs and other infrastructure known as Balance of Plant (BoP) along with related management and miscellaneous costs. O&M costs include WTG servicing and maintenance (~35% of total OPEX) along with WTG repairs and BoP maintenance (~15%). In addition management of these activities and managing the operation of the wind farm on a daily basis gives the remaining 10%.

Good AM vs Wind Farm Profits

Lastly it is important to understand what impact good asset management practices can have on wind farm profits. Good asset management has a double benefit – it ensures wind turbines are operating as much as possible (less down time) at maximum production (more revenue). As OPEX contributes 30-40% of total Cost of Energy (CoE = OPEX + CAPEX) and cost reductions are considered more attainable than for CAPEX, chasing gains on OPEX side can lead to savings of up to 10% of CoE.

Savings of 10% – now we’re talking a language even civil engineers can understand!